In digital marketing or online marketplaces, a “swap” can refer to a transaction or exchange of goods or services between two parties without involving monetary transactions. It often involves bartering or trading products or services of similar value. This concept is common in online communities, social platforms, or specialized websites where individuals or businesses can connect to exchange items or services without using traditional currency.

For example, on certain platforms, people may offer to swap items they no longer need or use with others who have something they desire. It can be a way to acquire goods or services without spending money and can foster a sense of community and resource sharing.

However, do note that “swap” can have different interpretations or specific meanings in various digital platforms or industries. If you have a particular platform or industry in mind, providing more details would help me provide a more accurate explanation.

SWAP arranges personalized orders for customers and delivers at their door steps. Hence, customers need not to worry about buying daily groceries or shopping some high-end gadgets, etc. SWAP works as one-stop solution for its valuable customers whether it is about buying, selling or exchanging with whatever products they want.

SWAP offers a seller to sell unneeded items at any convenient location and time, and accepts various payment methods either digitally or by cash. SWAP’s goal is to give endless options to consumers – when a consumer gets money by selling his/her unneeded stuffs, it automatically increases his/her purchasing power at that moment.

SWAP assists organizations to get rid of old products’ selling procedure by saving time for organization’s mundane works. SWAP purchases unneeded (used/new) products from your organizations such as mobiles, laptops, cars, bikes, work stations, etc. in bulk amount and also arranges exchange and office refurbishment.

SWAP organizes Activation Points at work places which help corporate employees to sell or purchase directly and avail exchange offers, gift cards, and so on. The employees also can enjoy special benefits in addition to our current offers in case of personal selling or purchasing respecting as a corporate client.

In a nutshell, SWAP is the only digital platform in the country that lets customers experience secure, hassle-free and haggle-free buying or selling or exchanging at shortest possible time with special privileges.

Different types of swaps?

What are different types of swaps?

- Interest Rate Swaps.

- Currency Swaps.

- Commodity Swaps.

- Credit Default Swaps.

- Zero Coupon Swaps.

- Total Return Swaps.

- The Bottom Line.

SWaP is an Acronym commonly used in the security/aerospace industries. It stands for Size Weight and Power. It refers to the Size, Weight, and Power Consumption requirements of specific components in full systems or for the whole system itself.

What is Swap Bangladesh?

SWAP is the combination of first ever e-commerce and re-commerce marketplace in Bangladesh where customers can purchase anything by personalized orders as well as sell their unneeded/surplus products such as smart phones, laptops, appliances, vehicles, etc. and exchange also.

SWAP is one and only re-commerce model in Bangladesh which focuses on consumers earning cash at quickest possible time. SWAP is first ever C2B marketplace where consumers will be able to sell off their old products like phones, laptops, appliances, vehicles and others within 24 hours to our verified merchants. This not only helps eradicate the safety and security issue that customers face in C2C marketplace but also helps any person to encase unwanted stuff at the earliest possible time. The goal of SWAP is to give endless options to consumers. So when consumer gets cash from his/her unwanted old stuff in SWAP, it automatically increases his/her purchasing power at that moment. This can be utilized to purchase from other offline stores, e-commerce or any marketplace.

While there are countless types of swaps out there, we have listed the most common ones below.

Interest Rate Swaps

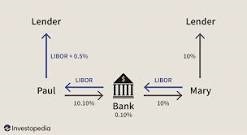

Interest rate swaps involve parties exchanging cash flows so that they can fedge against an interest rate risk or speculate. These cash flows are based on a notional principal amount that is agreed upon by both the parties (this amount is not exchanged). These are the most commonly used swaps and are also known as plain vanilla interest swaps. In this, party A pays Party B a predetermined (and fixed) rate of interest for a specific period of time on specific dates. Following this, party B agrees to pay party A on a floating interest rate with the same notional principal for the same amount of time on the same dates. The currency used in both the cash flows is the same and the dates (called settlement dates) are decided beforehand by both the parties. The payments are usually made monthly, quarterly or annually but the time interval can be set in any manner by the parties involved.

Commodity Swaps

Commodity swaps involve the exchange of a floating commodity price and consists of a floating leg component and a fixed leg component. The former is linked to the market price of the underlying commodity (like oil, fuel, precious metals, livestock, grains, etc) while the latter is specified in the contract as the producer of the commodity decides to pay a floating rate (it is determined by the spot market price of the underlying commodity). The most commonly used commodity for these swaps is crude oil and generally involve large institutions due to the nature and size of the contracts. A commodity swap is usually used to hedge against the price change in the market for crucial and valuable commodities like livestock, oil, etc. These are customised deals that are made outside of formal exchanges, without the oversight of an exchange regulator.

Currency Swaps

In a currency swap, both the parties exchange interest as well as principal payments on the debt (it is denominated in different currencies). This is not based on a notional amount but is exchanged along with the interest obligations. These contracts might involve different countries. For instance, the U.S. Federal Reserve and the European central banks were engaged in an aggressive swap strategy to stabilize the euro, as its value was falling because of the Greek debt crisis. These were initially used to get around exchange controls and government limitations on the purchase or sale of currencies and are often used by companies who do business abroad as they can help them get favorable loan rates in the local currency. These are considered to be a part of foreign exchange transactions and hence are not required by law to be included in the balance sheet of the company.

Debt-Equity Swaps

Debt or equity swaps act as a refinancing deal that involves the exchange of debt for equity. In this swap, the debt holder gets an equity position for the cancellation of the debt. It paves a way for struggling companies to relocate their capital structure. Since such companies can’t pay off their debts, they opt to get involved in debt-equity swaps to delay the payment. While some debt holders have to agree to this swap due to bankruptcy, others do have a choice in the matter as some companies engage in debt-equity swaps to reap the benefits of the favourable market conditions. The covenants in the bond indenture may oppose and prevent the swap without consent. For instance, businesses often offer attractive trade ratios like 1:2 wherein the bondholder receives stocks worth twice the value of his bonds, which makes the trade more enticing.

Total Return Swaps

In total return swaps, the overall returns from an asset are traded for a fixed (or variable) interest rate. This exposes the party that is paying the fixed rate to the underlying asset which is usually a stock, bond or index. Hence the second party can reap benefits from this asset without actually owning it. The parties involved in this swap are called total return payer and total return receiver.

Credit Default Swap (CDS)

In CDS, both the parties get into an agreement in which the one pays the lost principal and interest of a loan to the CDS buyer in case a borrower defaults on the loan. CDS swap was one of the major contributing factors in the 2008 financial crisis along with poor risk management and excessive leverage as the investors offset their credit risk with that of another investor. The majority of the CDS contracts are maintained via an ongoing premium payment (which is quite similar to the regular premiums due on an insurance policy) and usually involve mortgage-backed securities or municipal and corporate bonds.

How Interest Rate Swaps Work

Generally, the two parties in an interest rate swap are trading a fixed-rate and variable-interest rate. For example, one company may have a bond that pays the London Interbank Offered Rate (LIBOR), while the other party holds a bond that provides a fixed payment of 5%. If the LIBOR is expected to stay around 3%, then the contract would likely explain that the party paying the varying interest rate will pay LIBOR plus 2%. That way both parties can expect to receive similar payments. The primary investment is never traded, but the parties will agree on a base value (perhaps $1 million) to use to calculate the cash flows that they’ll exchange.

A currency swap is an agreement in which two parties exchange the principal amount of a loan and the interest in one currency for the principal and interest in another currency. At the inception of the swap, the equivalent principal amounts are exchanged at the spot rate.

In a currency swap, or FX swap, the counter-parties exchange given amounts in the two currencies. For example, one party might receive 100 million British pounds (GBP), while the other receives $125 million. This implies a GBP/USD exchange rate of 1.25.

Swaps were originally conceived as back-to-back loans. Two companies located in different countries would mutually swap loans in the currency of their respective countries. This arrangement allowed each company to have access to the foreign exchange of the other country and avoid paying any foreign currency taxes.

What does the acronym S.W.A.P. stand for?

From 1981-1995 the Surplus Program of UW-Madison collected a large variety of unwanted materials from the campus. In January of 1996, Surplus joined forces with another redistribution program on campus (known as the Solid Waste Alternatives project) to expand it’s collection and redistribution effort.

The Solid Waste Alternatives Project was initiated by UW-Madison’s Environmental Management program in November 1994 as an effort to find markets for low value surplus property. It was successful in not only finding these markets, but also in developing new technologies for marketing surplus property over the internet. This website is a direct result of that project. The Sales Program adapted the innovations of the SWAP Project and applied them to the new combined Surplus Services/SWAP program, now known simply as SWAP. SWAP now stands for Surplus With A Purpose to reflect our initiative to repurpose surplus university goods.